click this image for video

click the image below for ALL

website-page navigation buttons

or scroll down to

for page content

Go to Rabbit Hole Grand Central for links to all pages

Links to

more pages

you might

be interested

in

click image for video

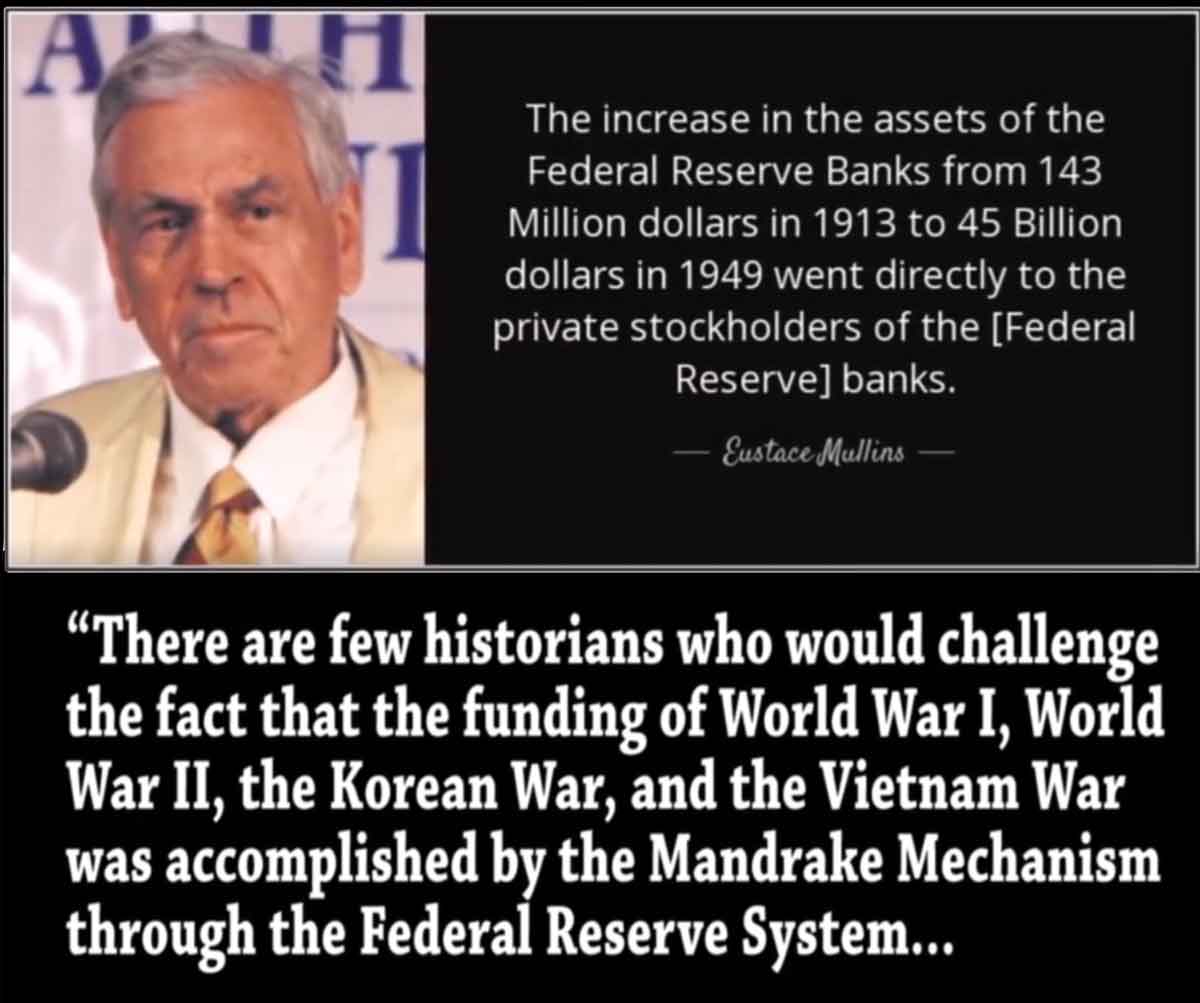

The bankers and governments

robbery of the people

And how they get away with it –

and still do, because we

LET THEM do it to us

thereby consenting to this robbery.

Most people, even realising this,

will continue to fund their criminal enterprises

out of the FEAR these institutions

encourage to intimidate anyone considering

not playing their game any more.

click image for video

The Banker![]() The Banker

The Banker

William Montague 3rd.

The Banker

Performed By Mike Daviot

Written, Directed and Produced By:

Craig-James Moncur

The Banker

Hello, my name is Montague William 3rd

And what I will tell you may well sound absurd

But the less who believe it the better for me

For you see I'm in Banking and big industry

For many a year we have controlled your lives

While you all just struggle and suffer in strife

We created the things that you don't really need

Your sports cars and Fashions and Plasma TV's

I remember it clearly how all this begun

Family secrets from Father to Son

Inherited knowledge that gives me the edge

While you peasants, people lie sleeping at night in your beds

We control the money that controls your lives

Whilst you worship false idols and wouldn't think twice

Of selling your souls for a place in the sun

These things that won't matter when your time is done

But as long as they're there to control the masses

I just sit back and consider my assets

Safe in the knowledge that I have it all

While you common people are losing your jobs

You see I just hold you in utter contempt

But the smile on my face well it makes me exempt

For I have the weapon of global TV

Which gives us connection and invites empathy

You would really believe that we look out for you

While we Bankers and Brokers are only a few

But if you saw that then you'd take back the power

Hence daily terrors to make you all cower

The Panics the crashes the wars and the illness

That keep you from finding your Spiritual Wholeness

We rig the game and we buy out both sides

To keep you enslaved in your pitiful lives

So go out and work as your body clock fades

And when it's all over a few years from the grave

You'll look back on all this and just then you'll see

That your life was nothing, a mere fantasy

There are very few things that we don't now control

To have Lawyers and Police Force was always a goal

Doing our bidding as you march on the street

But they never realise they're only just sheep

For real power resides in the hands of a few

You voted for parties what more could you do

But what you don't know is they're one and the same

Old Gordon has passed good old David the reigns

And you'll follow the leader who was put there by you

But your blood it runs red while our blood runs blue

But you simply don't see its all part of the game

Another distraction like money and fame

Get ready for wars in the name of the free

Vaccinations for illness that will never be

The assault on your children's impressionable minds

And a micro chipped world, you'll put up no fight

Information suppression will keep you in toe

Depopulation of peasants was always our goal

But eugenics was not what we hoped it would be

Oh yes it was us that funded Nazis!

But as long as we own all the media too

What's really happening does not concern you

So just go on watching your plasma TV

And the world will be run by the ones you can't see

Written By Craig-James Moncur

16/10/2009

click image for video

How the system works

Click on image for video

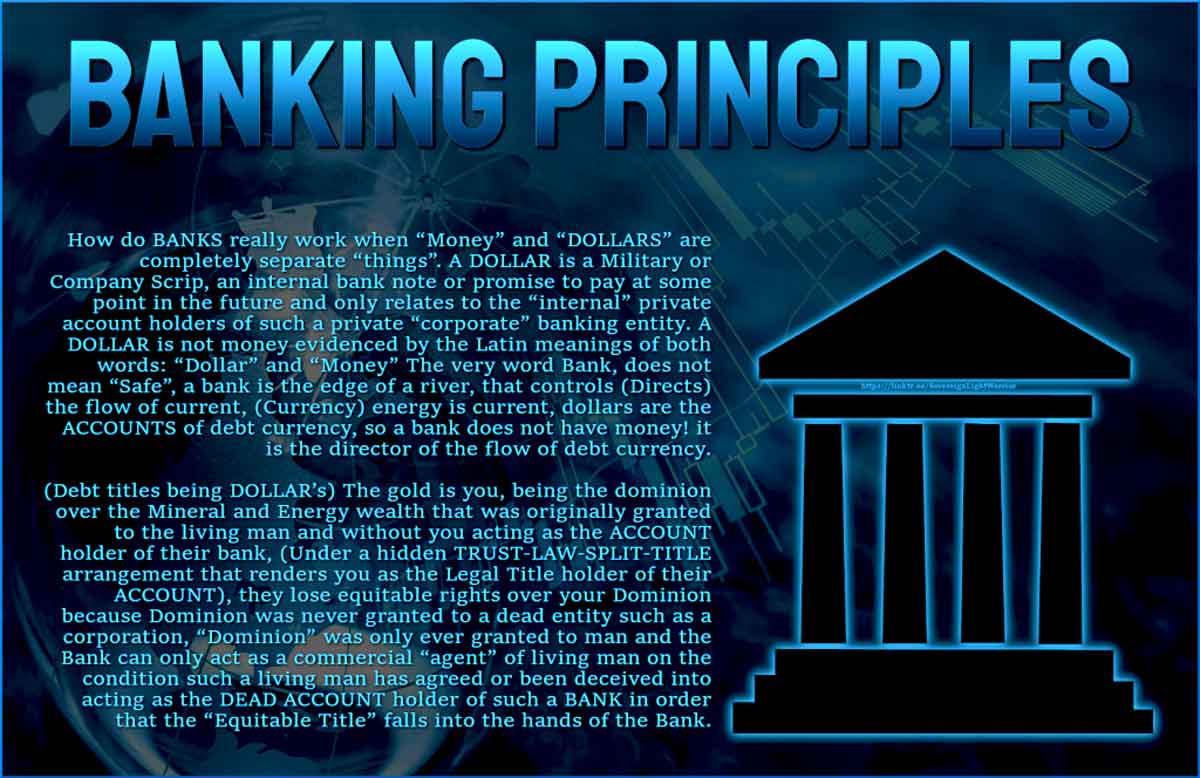

BANKING PRINCIPLES

How do BANKS really work

when “Money” and “DOLLARS”

are completely separate “things”.

-0-0-0-0-

A DOLLAR is a Military or Company Scrip, an internal bank note or promise to pay at some point in the future and only relates to the “internal” private account holders of such a private “corporate” banking entity.

A DOLLAR is not money evidenced by the Latin meanings of both words: “Dollar” and “Money” The very word Bank, does not mean “Safe”, a bank is the edge of a river, that controls (Directs) the flow of current, (Currency) energy is current, dollars are the ACCOUNTS of debt currency

So, a bank does not have money!

it is just the 'director' of the

FLOW of debt currency.

(Debt titles being DOLLAR’s)

The gold is you, being the dominion over the Mineral and Energy wealth that was originally granted to the living man and without you acting as the ACCOUNT holder of their bank, (Under a hidden TRUST-LAW-SPLIT-TITLE arrangement that renders you as the Legal Title holder of their ACCOUNT), they lose equitable rights over your Dominion because Dominion was never granted to a dead entity such as a corporation, “Dominion” was only ever granted to man and the Bank can only act as a commercial “agent” of living man on the condition such a living man has agreed or been deceived into acting as the DEAD ACCOUNT holder of such a BANK in order that the “Equitable Title” falls into the hands of the Bank.

The BANK sits between your “Christian” name (CERTIFICATE OF BIRTH) and your “SURNAME” (STATE BIRTH CERTIFICATE) as an Agent-administrator of the Christian name (Christian ACCOUNT. being the separate CERTIFICATE OF BIRTH, birthed on the registration date), Once the BANK can deceive you into assuming that “their” SURNAME, that looks a lot like your heritage name, (“Smith” is glossed into “SMITH”) the bank assumes consent in order to confer the legal title of the BANK to their SURNAME that you assumed was your property.

(ALL UPPERCASE TEXT is a foreign written language identified in article 11:147 of the: Chicago Manual of Styles 16th edition) Your surname glossed into a foreign SIGN language, is not your property! but when you attach your Christian name, being the name that is attached to your dominion, to their foreign ALL UPPERCASE SURNAME you, by your own consent, become subject to the ACCOUNT of their property … So simple but so effective and yet so biblically perfect once you violate the laws of the first GOD by serving the false God, GOD of the person-corporation.

The POWER of TRUST-LAW is the greatest power of all… Trust Law is Master-Servant, relationship, it does not work backwards, it is the system of conferring debt ACCOUNTS onto the unsuspecting…

The one who accepts LEGAL TITLE

is the one who acknowledges that the

Equitable Title is with the one who

granted such a man the LEGAL TITLE.

'LEGAL TITLE'

can not be held by a 'living man'.

Only a “Person”

(a corporation)

can hold 'Legal Title'

and what is a Person you may ask,

it is the legal title holder of man.

The thing that created the

“Person”, being a mask in a play,

was the VATICAN: “ROME”.

The Word “Vatican” means:

“vat I can”,

meaning ...

... “holder or vessel I can do”,

meaning, the VATICAN has become

the first Trustee Legal Title holder

of the dominion of the living man.

The VATICAN has become the beast of burden, it has no jurisdiction with living man because it agreed to act as the trustee… The VATICAN, that now held the Legal Title over the Dominion of man, offered the ACCOUNTS of the Legal Title to its own Persons by offering such a title to a living man and only when the living man was deceived into accepting such an ACCOUNT, did such a man become the “assumed debtor trustee person” of the world debts of the VATICAN and such acceptance of such an ACCOUNT was the “conformation” that granted Equitable Title back to the VATICAN because the living man accepted Legal Title, rendering the living man to fall into the jurisdiction of the DEAD ACCOUNT holder of the VATICAN beast instead of being the first trustee to the real GOD of living man.

The VATICAN is the

GOD of the dead persons

because it was not God of man that created

the DEAD juristic corporate Person, it was

the VATICAN that created such a thing as the “Person”.

The VATICAN

is the false GOD.

Click on image for video

Foreclosure

DON’T leave your home!

Foreclosure or mortgagee

sale on your house….

What does it really mean

and how do you legally

stand your ground..🤔🤔

Don’t leave your home!

Don’t argue…

…just learn the correct questions to ask!!

Click on image for video

The Great British

Mortgage Swindle

Release Date: 2016

The Great British Mortgage Swindle is a captivating and thought-provoking documentary that exposes the chilling reality of institutionalized mortgage fraud and the brutal consequences of eviction-based genocide.

Over the course of eight years, this powerful film follows the harrowing and inspiring journeys of five courageous lay litigants, as they fight to protect their homes from unlawful repossession, driven by fraudulent mortgages and void court orders.

The documentary reveals the shocking truth that a staggering 11.2 million registered mortgages in the UK are not only void and unenforceable but also marred by fraudulent signatures and absent witnesses.

The Great British Mortgage Swindle is a must-see documentary that exposes the systematic corruption within the financial and judicial systems, leaving viewers both outraged and inspired.

The film’s relentless narrative builds to a triumphant climax as the protagonists take on the corrupt institutions in her Majesty’s courts, ultimately giving rise to a grassroots movement that aims to end institutionalized mortgage fraud and eviction-based genocide.

-0-0-0-0-

ONE OF THE GREATEST

COMMON LAW DOCUMENTARIES

Make sure you watch to the end as it has a lot of important info will give you lots to think about

On June 28th 2015, Michael of Bernicia gave an incendiary presentation at the Dignity Alliance venue in Ashton-in-Makerfield, which he dubbed The Great British Mortgage Swindle, the title of the coruscating documentary feature film that Michael has spent the last six years co-producing with Michael of Deira.

During the course of the compelling presentation, Michael deftly describes, dissects and disembowels the nature of The Great British Mortgage Swindle and the seemingly futile quest for justice in her majesty’s courts, which he vehemently condemns as nothing more than a rigged game in favour of the Banksters and their minions, by which the crown house of Rothschild is sweeping up all the land and resources that it hasn’t already stolen from the people.

Since the legal professions, the judiciary, the police and politicians of every persuasion are complicit in crimes of institutionalised mortgage fraud, whilst every office of local government is engaged in the ruthless implementation of UN Agenda 21, which seeks to dramatically reduce the population of the Earth by up to 85% [in the name of “sustainable development”], Michael passionately evokes the spirit of his ancestors in a heart-felt plea that the people of Britain unite to put an end to the tyranny which is running rampant, by forming Peace-Keeping Forces and Grand Juries in every community.

Click on image for video

The Incredible Mortgage Scam

After more than six months of research brought about by five court cases in Canada and the U.S., where people were losing their homes, it became more than apparent that the Admiralty court system has been weaponized against We the People.

People have been losing their homes through a conspiracy to commit fraud, beginning at the highest levels of the banking industry.

They’re all in it — the courts, the BAR attorneys, the government, and law enforcement.

It’s the largest scam in the history of mankind.

The numbers are staggering.

This is how they do it.

Click on image for video

How to be a crook

(and rob people

and get away with it)

narrated –

Larken Rose

click image for video

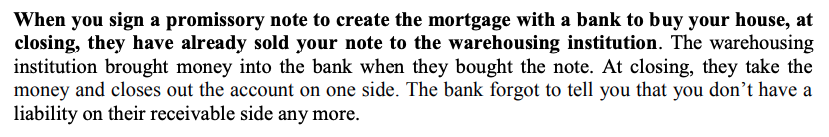

The FRAUD of Mortgages

MORTGAGES

DAYLIGHT ROBBERY

HOW THEY LEND YOU BACK

YOUR OWN MONEY

AND STEAL YOUR PROPERTY

BANK MORTGAGE BUSINESS

IS AN UNCONSCIONABLE SCAM

THE PROCESS STEP BY STEP

1. Borrower signs the bank’s Loan Contract and Mortgage.

2. Borrower’s signature transforms the Loan Contract into a Financial Instrument worth the value of the agreed Loan amount.

3. Bank Fails to disclose to borrower that the borrower created an asset.

4. Loan Contract (Financial Instrument) asset deposited with the bank by borrower.

5. Financial Instrument remains property of borrower since the borrower created it.

6. Bank Fails to disclose the bank’s liability to the borrower for the value of the asset.

7. Bank fails to give borrower a receipt for deposit of the borrower’s asset.

8. New money credit is created on the bank books, credited against the borrower’s financial instrument.

9. Bank fails to disclose to the borrower that the borrower’s signature created new money that is claimed by the bank as a Loan to the borrower.

10. Loan amount credited to an account for borrower’s use.

11. Bank deceives borrower by calling credit a “Loan” when it is an exchange for the deposited asset.

12. Bank deceives public at large by calling this process Mortgage Lending, Loan and similar.

13. Bank deceives borrower by charging Interest and fees when there is no value provided to the borrower by the bank.

14. Bank provides none of its own money so the bank has no consideration in the transaction and so no true contract exists.

15. Bank deceives borrower that the borrower’s self-created credit is a “Loan” from the bank, thus there is no full disclosure so no true contract exists. Borrower is the true creditor in the transaction. Borrower created the money. Bank provided no value.

16. Bank deceives borrower that borrower is Debtor not Creditor

17. Bank Hides its Liability by off balance-sheet accounting and only shows its Debtor ledger in order to deceive the borrower and the Court.

18. Bank demands borrower’s payments without just cause. Deception-theft- fraud.

19. Bank sells borrower’s Financial Instrument to a third party for profit.

20. Sale of the Financial Instrument confirms it has intrinsic value as an asset, yet that value is not credited to the borrower as creator and depositor of the Instrument.

21. Bank hides truth from the borrower, not admitting theft, nor sharing proceeds of the sale of the borrower’s Financial Instrument with the borrower.

22. The borrower’s Financial Instrument is converted into a security through a trust or similar arrangement in order to defeat restrictions on transactions of Loan Contracts.

23. The Security including the Loan Contract is sold to investors, despite the fact that such Securitization is Illegal.

24. Bank is not the Holder in Due Course of the Loan Contract . Only the Holder in Due Course can claim on the Loan Contract.

25. Bank deceives the borrower that the bank is Holder in Due Course of the Loan.

-0-0-0-0-0-

More information about

‘Holder in Due Course’

1. Acquiring Holder in Due Course Status

| Negotiable Instruments

![]() 1. Acquiring Holder in Due Course Status

1. Acquiring Holder in Due Course Status

2. What is a

Holder in Due Course?

![]() 2. What is a Holder in Due Course?

2. What is a Holder in Due Course?

3. Rights of a Holder in Due Course

| Negotiable Instruments

Banks are thought of as

being intermediaries,

but this not really

what’s happening.

Banks are creators

of the money supply.

I produced the first empirical studies to prove

that [banks create money out of thin air.

Banks are thought of as deposit-taking institutions that lend money.

The legal reality is banks don’t take deposits and banks don’t lend money.

So what is a deposit?

A deposit is not actually a deposit.

It’s not a bailment.

And it’s not held in custody.

At law, the word deposit is meaningless.

The law courts and various judgements have made it very clear

if you give your money to a bank even though it’s called a deposit,

this money is simply a loan to the bank.

So there is no such thing as deposit.

It’s a loan at a bank.

So banks borrow from the public.

So that much we’ve established.

What about lending?

Surely they’re lending money.

Umm.

No, they don’t.

Banks don’t lend money.

Banks again, at law, it’s very clear.

They’re in the business of purchasing securities.

That’s it.

So you say. OK.

Don’t confuse me with all that legalese.

I want a loan.

Fine, here’s the loan contract.

Here’s the offer letter.

And you sign.

At law, it’s very clear, you have issued a security.

Namely a promissory note.

And the bank is going to purchase that.

That’s what’s happening.

What the bank is doing is very different

from what it presents to the public that it’s doing.

How does this fit together?

So you say fine, the bank purchases my promissory note,

but how do I get my money?

This is a loan.

I don’t care about the details.

I want the money.

The bank will say you’ll find it in your account with us.

That would be technically correct.

If they say, we’ll transfer it to your account,

that’s wrong because no money is transferred,

at all, from anywhere inside the bank or outside the bank.

Why?

Because what we call a deposit,

is simply the bank’s record of its debt to the public.

Now it also owes you money [for the promissory note]and its record of the money it owes you

is what you think you’re getting as money [as a loan].

And that’s all it is.

That is how the banks create the money supply.

The money supply consists to 97 percent of bank deposits

and these are created out of nothing

by banks when they lend.

Because they invent fictitious customer deposits.

Why?

They simply restate, slightly incorrectly in accounting terms

– what is an accounts payable liability arising from

the loan contract having purchased your promissory note

– as a customer deposit.

But nobody has deposited any money.

I wonder how the FCA [Financial Conduct Authority]

deals with this because in the financial sector

you’re not supposed to mislead your customers.

click image for video

How Banks Enslave Humanity

GREG REESE

click image for video

We are born on the land

and are considered

heirs of the land assets

of our country.

But within hours of our birth

undeclared agents get our mothers

to sign certificates of our live bErth

which assign us to a lifetime of

debt slavery we can never escape from

with debts we can never repay.

And it’s all based on a fraud

we’re not even aware of

and we live in it all our lives.

These documents are misrepresented as simple recordings of our birth and they become registrations of us as commercial vessels using the name our mothers give us and serving to make the ‘state’ franchise the beneficiary of our estate on the land.

Many days, weeks or months later as determined by ‘state’ law, our “vessel In commerce’ Is reported missing-at-sea and we are presumed dead to the probate court which ‘doctors’ the civil records and converts our living estate to a trust ESTATE benefiting the perpetrators of this scheme.

You are now OFFICIALLY DEAD with the land Jurisdiction and unless you take action to correct the probate court records you and your assets are permanently trapped In the International Jurisdiction of the sea.

You are therefore unable to take recourse to your holdings on the land or the law forms of the land you are owed.

Ever heard the constitution called the “Law of the Land’?

This Is why your constitutional guarantees don’t apply.

There’s no version of ‘YOU’ operating on the land as a result of this fraud – you’re DEAD

That you was totally unaware that you needed to inform the probate court that you are actually alive in necessary for this fraud to persist.

The fraud is based on identity theft and unilateral adhesion contracts that are obtained under condition of deceit while you are still just a baby.

There is no possibility that you, or anyone else, could know this fraud is going on or have an opportunity to do anything about it.

That’s how fraud works.

At the moment you enter this world you are kidnapped and press-ganged into the International Jurisdiction of the sea and your ESTATE Is claimed and pillaged before you leave Junior school at age 7.

(You are presumed Lost-at-Sea’

and maritime law allows you 7 years

to claim ownership of your goods

before they can be claimed by

whomever ‘salvaged’ them).

Who are the monsters/parasites who are robbing you?

None other than the ‘prestigious’ IMF and FEDERAL RESERVE, other criminal international banking cartels, the American and English legal BAR Associations which use the mumbo-jumbo of legalese no-one can understand to confuse people so it can benefit and profit from this fraud.

The IMF does it’s business as the ‘UNITED STATES INC.’ and has franchises doing business for it like the ‘CITY OF LONDON CORPORATION‘ in every state in America.

While they sound ‘official’ they might as well be locations of hamburger or coffee stores or supermarket chains.

The FEDERAL RESERVE Is the official sounding name of the corporation doing business as the ‘THE UNITED STATES OF AMERICA INC.’

It OWNS’ and controls EVERY other bank IN THE WORLD.

It makes out It Is a US bank but It Is owned by private bankers not ordinary citizens.

Yet, none of these corporations has

ANY legal or lawful authority over you

and your assets.

However, their fraud scheme does give them control of your ‘ESTATE‘ which was created by them without your knowledge or permission.

They do this by creating a fictional character they call a ‘strawman’.

As you are dead, your strawman (who Is not you and does not exist) acts on your behalf when dealing with these parasites and is the entity they write to with their fake demands for payment called ‘bills’.

And your strawman simply

pays ALL those bills,

with YOUR money,

without ever querying

their size or origin.

Your strawman, while he looks like he’s working for you, is actually working for the parasites to suck your financial lifeblood away from you and give it to them

Your strawman is contacted by them, in code he understands, with letters addressed using all UPPERCASE characters in your name and address.

They look like they’re addressed to you, but they’re not – you just think they are, so you pay them.

But, ALL these bills

needn’t be paid by you.

They don’t belong to you

and wasn’t sent to you.

In fact, ironically, It Is an offence to tamper with mail not addressed to you and, strictly speaking, it should be returned unopened as ‘not known’.

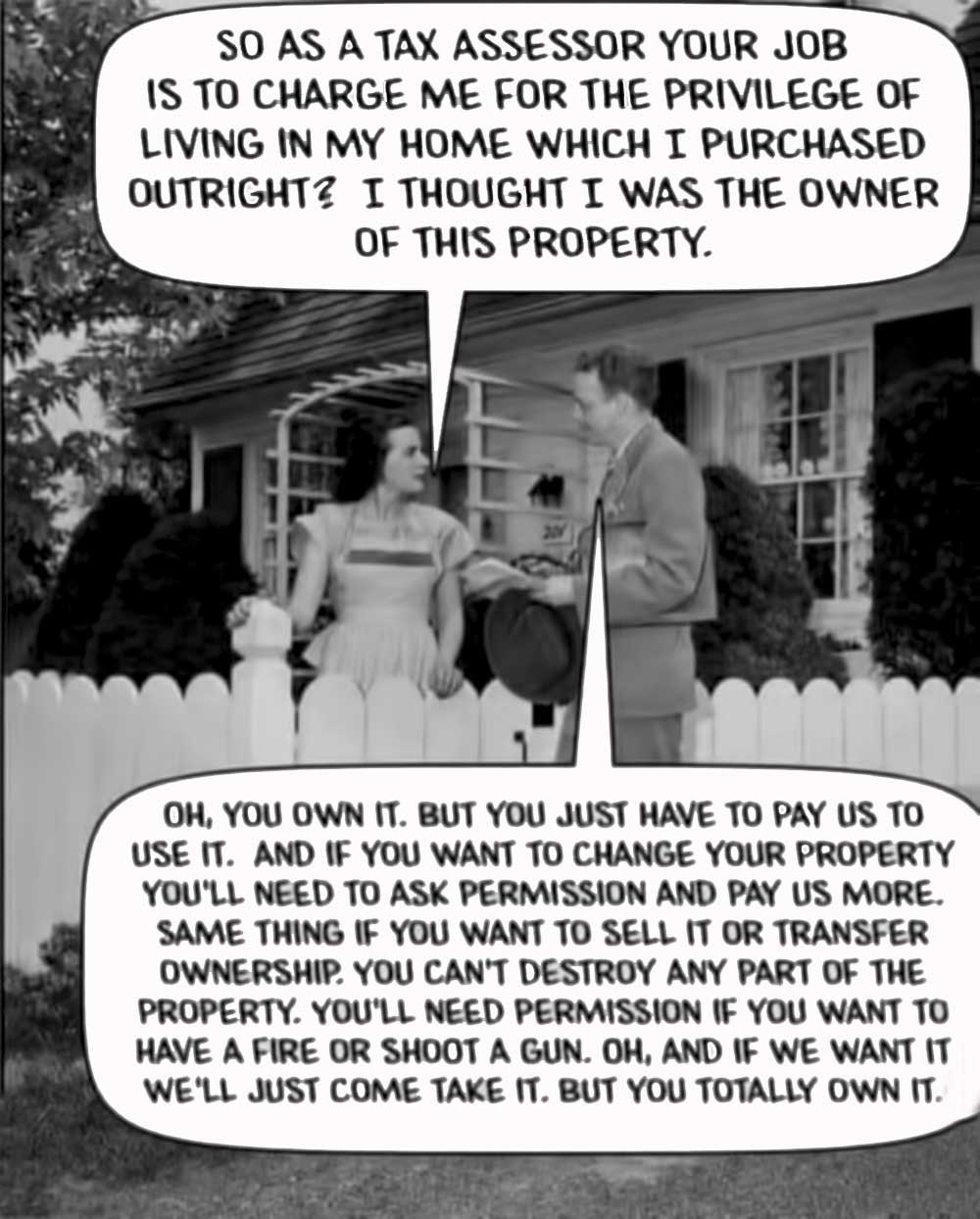

Have you ever wondered why

THERE ARE so many rules and

regulations for us to ‘break’

AND WHY we get so many

fines/levys/fees charges/registrations

to pay … and on they go.

Think about it – if the ‘rules’ was so important

to not be broken then we’d be warned about the rule.

But, not only are we NOT warned,

we often don’t even know a ‘rule’ exists.

And, if one does, we’re actually encouraged

to break it even unknowingly.

It’s a TRAP – and you know it is.

Turns out, the ‘system’ is more concerned about

photographing us breaking a rule than it is

about preventing whatever the ‘rule’ is we’re ‘breaking’.

We have ourselves to blame for this

It’s because, like robots,

we simply PAY THOSE FINES

without even thinking about why we should

even when there’s no need to PAY THEM AT ALL.

It’s an INDUSTRY that sucks the financial life

out of us without providing ANY service or benefit.

It’s 100% PROFIT for whomever’s running it.

It’s a SCAM that we encourage and feed with

our SILENT COMPLIANCE

We’ve been

TRAINED ALL OF OUR LIVES to be SCARED OF

and COMPLIANT TO a system that’s learned

how to look us straight in the eye

while it cleans out our pockets

This system has got us convinced that

if we don’t pay up then it will come and ‘get’ us.

All to keep us poor and enslaved and in debt.

ALL OF OUR LIVES

If YOU’VE HAD ENOUGH

of this robbery and decided it’s time

to ‘DO’ something but wondered what.

If you want to ‘grow a pair’ and take on the system –

the information links on this page are ‘for’ you.

If you’re actually in the situation

where they’re ‘coming after you’

and you got nothing to lose and everything to gain …

you MUST read this/study this if

you want to turn from another victim to victor.

There’s loads of links to videos and reference material

that shows you not just WHAT to do but HOW to do it

USING THE LAW to DEFEAT these robbers.

And, in reality, it’s not that hard.

All it needs is for people to look straight back

at the system and squeeze BACK a bit.

End of the day, it’s your choice

but if you do choose to do nothing

it will cost you – again and again

and, eventually, they’ll take EVERYTHING.

Make no mistake, our ongoing compliance

and whimpering submission

will ONLY MAKE THINGS WORSE for us.

If we don’t stand up to this robbery, then

EVERY DAY they’re encouraged to invent

NEW ‘RULES’ for us to break

to keep the system‘s coffers

filled with OUR MONEY.

THEY GET OFF ON OUR MISERY

and don’t care if you can’t feed your family

or have nowhere to live

Note

we have NO association with the authors of this information

which is here for education purposes only.

We found it – and reckon it’s worth sharing

click image for video

Richard Vobes

How they secretly control us

Today I want to demonstrate that

‘they’ have been dumbing us down

for generations and manipulating

us with their silent weapons.

click image for video

Infringement Notice

Victoria Police

If we’re ever to make a difference

it’s going to need peeps to figuratively

‘Man Up’ and ‘Grow a Pair’ –

if we ALL did, they’d be so

bogged down with admin

and with no funds to support

the system we pay for to rob us.

Bedlam for them

This is satire, not legal advice.

1. You’ve received an infringement in your FICTION NAME.

2. Scan a copy of notice & envelope (keeping evidence of the fraud).

3. Write in red pen over top of letter ‘Offer Declined‘ & the date write it twice

4. Put it back into envelope, wrote in the front in red pen, ‘Offer Declined. No consent = No contract. Date.

5. Must post back within 3 days of receiving. If you don’t that’s consented acquiescence.

6. Before sending, let’s look at the logo on the letter.

The crown is of the Vatican an inverted pentagram, coat of arms of the Rothschilds.

We will make up a letter to express knowledge.

You write – I am not a subject of the Vatican,

I do not consent to any Roman laws or Masonic laws.

7. Beneath the logo it’s marked ‘VICTORIA POLICE’ but has no ABN so it’s not lawful.

So you wrote under it in red pen ‘Dog Latin’ ‘No ABN’ By them not indicating if VICPOL is a corporation it makes the entire infringement a counterfeit & criminal.

8. Top of doc, INFRINGEMENT NOTICE – write in red pen – DOG LATIN.

You are not THE OPERATOR as you are the living man/woman not The Fiction.

9. Top right- Obligation number.

Trying to give you a customer number for you to contract with.

10. All ‘offense details’ to the left again circle and mark in red as DOG LATIN.

Note it says ‘alleged offense’ as there was no living witness, only a camera.

11. Right blue box – No ‘Infringement penalty’ can be placed until proven guilty in a court of law.

12. Centre of the letter ‘Road rule 20’ again not lawful, mark in red pen and circle ‘Statutory legislation requires consent’.

13. In payment options see it’s says again the word ‘you’ but who is you?

And who is ‘driving’ unless doing commerce you are only travelling.

Or shut up and keep paying up,

until you can’t afford the

increasing penalties any more.

click image for video

Car registration explained

Most people believe that when they buy a new car, that they HAVE to register it (In Britain, with the commercial company known as “The Driver and Vehicle Licensing Agency”).

What very few people are aware of is the fact that the ‘act’ of applying for registration actually transfers the physical ownership of the vehicle from (you) – the purchaser who PAID the MONEY, to the ‘DVLA’ who licensed the vehicle.

That is, my friends, exactly how you give your vehicle away to a commercial company who has done NOTHING AT ALL for you and which does NOT have your best interests at heart.

Knowledge is Power explains how;

The change of ownership is shown by the fact that you, the previous owner, are now sent a document stating that you are now “the Registered Keeper” of the vehicle which you have just bought. You are left to pay for maintaining the vehicle which you do not own, and the actual owner can, and will, destroy the vehicle (which cost the owner nothing) if you, the ‘Registered

Keeper’ do not keep on paying for the use of the vehicle.

Destroying the vehicle would be unlawful if the vehicle did not belong to the company doing the destroying. (Clever plan, when you think about it BUT NOT LAWFUL!)

The vehicle will be crushed if the “Road Tax” is not paid. That ‘tax’ is substantial and was originally introduced as a fund contributed to by the drivers of vehicles, in order to build new roads for those vehicles to drive on, and to maintain all existing roads.

That was a very reasonable idea, and it means that all the roads in the country belong to the people who paid the money for them to be built and repaired.

HOWEVER, that Road Tax Fund has been hi-jacked and I have seen reports that state that 85% of that money is taken for other things which are in no way related to roads or driving.

Local Authorities say that they can’t maintain roads properly as they do not have sufficient funds to do the work. The ‘Road Tax’ is increased for vehicles with large engines on the laughable excuse that they burn more fuel and so contribute more to global warming!!

THE REAL reason for the increase is, as ever, just a method of taking more money from people who have no idea what is going on!…

There is even a proposal now, that motorists be charged for every mile that they drive along the roads which they paid for and own. That, of course, is not the only stream of income from vehicles.

A major source of income is from the massive ‘tax’ on fuel for vehicles, and it has been stated that an incredible 85% of the selling price is the proportion which is not needed for the location, extraction, processing and delivery of the actual fuel.

In passing it can be remarked that vehicles can be run on water, compressed air, energy direct from the environment, permanent magnets, and even on gravity. It, no doubt, will come as a great shock to you that the inventors who have done this have disappeared suddenly as soon as they started testing their prototypes.

Far-fetched?

I personally know three people who have been told to “cease and desist – or else”. When you understand the billions and billions in profit which are made through selling oil products, actions like that become very understandable, especially since the people who do these things own the police forces and courts and so they know that there will be no comeback no matter what they do.

You would think that there could be no further money to be squeezed out of the person who buys a car, but that is not the case.

There are two further major charges.

1.is an import duty on vehicles brought into the country from outside and that can be a substantial amount.

2. Is a most damaging charge called “Value Added Tax” in Britain and “Sales Tax” elsewhere. That tax is at present, 17.5% and forms a major increase in the selling price of almost everything.

No matter how much your earned income is taxed, the remainder will be used to make purchases, almost all of which will be taxed themselves and the components used in their manufacture, transport and advertising are themselves taxed, raising the price even further.

When these things are taken into account, it has been estimated that 80% of a person’s earnings is taken away by the various taxes and other unnecessary charges! Professional economists have stated that the supposedly-free people living in ‘democratic’ Britain are actually substantially worse off than the ‘serf’ slaves of earlier times – SO MUCH FOR FREEDOM!

So, what about the Driving Licence or in America, the Driver’s Licence?

Under Common Law, living mans have the right to travel freely and these days, that includes using a vehicle when travelling. The Legalese people want to persuade you that you are no longer a “Traveller” under Common Law, but instead, you are a “Driver” subject to their statutes, and they demand that a “Driver” must have a driving licence, car tax, car insurance, and anything else that they can think up.

If you wish to live in freedom and somebody asks to see your licence (which would have been issued by your ‘begging’ for the supply of one and so subjecting yourself voluntarily to their authority by doing so).

Then the question is “Why would I want one of those?”.

A driving licence is only needed for the driver of a vehicle which is taking part in Commerce. It can be argued that transporting a Legal Fiction / Strawman is a commercial undertaking, so it would be advisable not to have anything related to a Legal Fiction / Strawman with you.

It is also very important not to give your name, address or (supposed) date of birth or to show any form of ID as that places you in a position of voluntary submission by:

(a) Obeying the command of another living man being (who is of equal standing to you) and/or (b) Associating yourself with, and consequently representing, a strawman who is automatically subject to all statutes, being itself, a legal fiction and part of that fictional world.

So, if you are not carrying a passenger who is paying for the journey and you are not stopping off on the journey to sell things and you are not transporting a Legal Fiction / Strawman, then you are not a “Driver” with a “Passenger”, but instead, you are a “traveller” with a “Guest” if you are accompanied by a living man who is not a “person” and who is not carrying a Legal Fiction / Strawman around with him. Travelers do not need a driving licence.

click image for video

PARKING CHARGES?

THIS IS SO MUCH MORE!

CONSENT OF THE GOVERNED

The Observation Deck is a channel which explores lesser known views on many subjects. From history to the roots of modern scientific facts and theories. Rather than seek to change the minds of subscribers, I simply pose views some may not have considered and leave the rest up to you.

I guess it actually is “For elucidation purposes only” and I hope you enjoy your journey of self-discovery and much as I do.

My opinions about the content are simply that, my opinions, and should not be taken as fact but rather as additional information you can form your own opinions about.

As the saying goes…

“I don’t want you to think like me, I just want you to think.”

We live in a universe of impossible possibilities and the Observation Deck acts as a vehicle to explore the known and unknowable in equal amounts.

Click image for video

EXPLOSIVE

evidence of

UK Government fraud

Former policeman, Gary Waterman,

joins me to expose a huge government fraud

surround illegal practices at Company House

and the registration process, and how this

makes the tax system unlawful.

click image for video

Council Rates pay or not to pay?

… continued

click image for video

Councils

are

Corporations

When a corporation sends you an

invoice for money,

like a Council Tax demand,

one has to ask,

where is the contract, the obligation,

the agreement that you made with them?

click image for video

Bailiff access denied

More and more people are

beginning to recognise their

common-law rights and are

gaining confidence to do

something about tactics from

debt collectors to extract money.

Click image for video

Don’t get court…

click image for video

THE STRAWMAN PROCESS

PART 1 – WHY DID

YOUR STRAWMAN GET BORN

click image for video

THE STRAWMAN PROCESS

PART 2

AN EXERCISE IN

RAISING AWARENESS

Click image for video

Breaking

Global Financial News

w/Patriot Rod Steel

& Dr. Kia Pruitt

Friday, June-28-2024

Rod Steel gives information on

the current world financial situation

NESARA/GESARA

If you’re financially under pressure right now,

you might get some useful information here.

much ALL good news!

author unknown

November 30th 2023

EMERGENCY BROADCAST SYSTEM

PENTAGON EXPOSURE CONNECTED

TO PLANDEMIC WORLDWIDE LOCKDOWN AGENDA 21 2023

This ‘Emergency Broadcast’

has been talked about for ages

on the ‘truther’ channels –

some even giving predictions about the timing.

Do not be relying on ANY information

from ANYWHERE regarding this …

… but – be ready for EVENTS to unfold to

EXPOSE the CABAL DEEP STATE

AGENDAS

-0-0-0-0-

You will know we are right around the corner from a NEW WORLD

Do not get angry, and do not panic.

This is NEEDED.

Yes it TRULY must HAPPEN like this so we can TRANSITION to a BRIGHT FUTURE.

It is part of the SCRIPT and LAST PHASE of, indeed gut wrenching, AWAKENING movie that was necessary to AWAKEN the masses.

This will ensure EVERYONE is SAFELY placed in their HOM and able to WITNESS the HISTORICAL moment that REVEALS all of the TRUTHS, cover ups etc. through the EBS which is imminent.

All is SCHEDULED to HAPPEN. so get PREPARED.

Circle the DATE on your calendar and PLEASE pay attention.

-0-0-0-0-

There must be a TEST and then a review of all OCCURRENCES and ACTIVITIES.

The possible implications on a NATIONAL and GLOBAL level can be quite COMPLICATED so things must be in ALIGNMENT to the PROTOCOLS.

Yes there are many consequences if things aren’t done with PRECISION and perfection.

This is the PRACTICE run before the REAL ONE to see responses and accuracy to what is FORTHCOMING which changes HUMANITY.

We hear the SCHEDULE is now FINALLY firm, but again I’m just the MESSENGER.

Be READY to adjust if needed in regards to possible TIME changes.

Only a SELECT few know the MOMENT of exact and precise TIMING of EVENTS.

For SECURITY and other obvious reasons it must be properly kept PRIVATE.

Again the EBS is going to AIR playing an 8 HOUR VIDEO.

It will be replaying 3 TIMES a day for 10 DAYS Communication DARKNESS.

During those 10 DAYS of Communication DARKNESS the following things will happen.

We will RECEIVE 7 TRUMPETS aka EBS text MESSAGES on our PHONES alerting US to tune into our TV at this TIME.

Our PHONES will only work for 911 and we are INFORMED the Signal App, which is MILITARY encrypted will be available.

Our TV’s will only show 3 EXPLANATORY MOVIES on a continuous loop for the 10 DAYS.

-0-0-0-0-

It will cover topics of ARRESTS, TRIBUNALS, FRAUD CORRUPTION, PEDOPHILIA etc.

Our INTERNET will not work during that TIME.

Our ATM’s will not work.

After the 10 DAYS of Communication DARKNESS, we will connect to a new QUANTUM internet.

People are urged to STOCK UP on at least THREE WEEKS of FOOD and WATER.

We are PROMISED the new Star-link Internet System by the end of the month.

Again I repeat be PREPARED with FOOD, WATER, TOILET PAPER, generators etc. for this GREAT AWAKENING REVEAL.

As we speak the TEAMS coordinating this IMPORTANT HISTORIC EVENT are revamping the EBS to ensure the utmost SECURITY for all INVOLVED so remain PATIENT as things get finalized.

They want to make CERTAIN there are not any interferences of any sort at all.

-0-0-0-0-

Those making the PLAN want no ONE to PANIC because it’s simply the release of the TRUTH.

After the EBS and we’ve gone through the 10 DAYS mainstream media BLACKOUT and sat through all the 24/7, (eight hours long movies) do we go back to NORMAL like business as usual?

Answer is: After EBS and the 8 hours long 24 7, movies all will change.

The, LIFE support, attached to the OLD and EVIL systems will be PULLED.

HUMANITY, and PLANET EARTH simultaneously move to QUANTUM reality consciousness system (PEACE and PROSPERITY).

END of FINANCIAL and HUMAN consciousness ENSLAVEMENT.

Old systems of GOVERNMENT, EDUCATION, FINANCE, HEALTH, TRADE and COMMERCE etc., will all be DISMANTLED and REPLACED.

-0-0-0-0-

We will have new CURRENCY called the USN US NOTE and GOLD backed.

The TIME is now to ALERT as many who will LISTEN.

Do not have too much PRIDE.

Go WARN those you LOVE even though they think you’re CRAZY.

Your GOAL for OTHERS is TRULY to HELP absorb the SHOCK of what is COMING.

Stay strong PATRIOTS and STOCK BACK UP ON FOOD RESOURCES.

SUPPLIES for the EVENTS happening and coming.

We are inside the STORM MAJOR EVENTS HITTING

Everything is leading to MILITARY CRIMES AGAINST HUMANITY

-0-0-0-0-

click image for video

The Great Taking

David Webb exposes the system

the Central Bankers have in place

to take everything from everyone.

DAVID WEBB EXPOSES

THE GREATEST CRIME

EVER CONTEMPLATED

David Webb exposes the system Central Bankers have in place to take everything from everyone.

Former hedge fund manager David Webb takes the audience step by step through his forensic investigation into the legal, financial and regulatory changes that have set up “the greatest crime ever contemplated … the planned confiscation of everyone’s global securities assets.”

Webb, author of a book by the same title, exposes the “scheme by central bankers to subjugate humanity by taking all securities, bank deposits and property financed with debt.”

“Legal certainty has been established that the collateral can be taken immediately and without judicial review, by entities described in court documents as ‘the protected class,’”

Webb says in the film. “Even sophisticated professional investors, who were assured that their securities are ‘segregated,’ will not be protected.”

President and CEO Mary Holland, Webb said he has been studying global financial systems and warning of a coming “Great Taking” financial collapse for more than 20 years.

His decades of hedge fund experience gave him insight into money flows and systemic risks that he believes foreshadow an orchestrated crash.

Webb spent years researching historical precedents like Great Depression-era bank closures and gold confiscation to help him understand the “playbook used by powerful banking interests during times of financial turmoil.”

He first noticed that money velocity rates showed how excessive money creation drives unstable economic bubbles.

The mainstream news coverage during the 1990s Asian financial crisis aftermath did not fully explain the odd market movements he was seeing.

Digging deeper, Webb realized “the scale of the money creation during this period was very high.”

He found Federal Reserve Board activity generating over 1% of gross domestic product worth of new money in one week — “an order magnitude bigger” than annual growth rates, he said.

The massive liquidity influx was not going into the real economy, Webb said, but into “destructive things … wars… various operations that are about control.”

Webb compared the state of the economy just before World War I to today’s hyper-financialized economy, saying both are about “looting” in the late phase of economic bubbles, just prior to a crash.

Webb also witnessed a decade-long campaign to change commercial banking statutes and ownership definitions, state by state, that set the stage for revoking investor property rights during defaults.

“The underpinning of the entire securities infrastructure in the U.S. is the Depository Trust and Clearing Corporation, and this is the entity that was first formed to dematerialize all securities in the U.S.,” Webb said.

Webb told Holland a career CIA operative with “absolutely no background and banking or finance” was involved in this project and was later made the superintendent of banks in New York state by Nelson Rockefeller.

“It’s very clear that this was a CIA project,” he said.

click image for video

WHO OWNED EARTH?

click image for video

The Biggest Banking Scam

of ALL TIME

Explained in 7 minutes

Banks are here to help you SAVE money.

Whoever thought that one up deserves a Nobel prize in advertising BS.

Never before in the history of the world has there ever been set up an institution designed to keep you poor and indebted all your life, (and, by default, enslaved), as the banking industry.

This page will endeavor to demonstrate/illustrate how the illusion is done.

There is so much information about how we’re being screwed by banks, this page has the potential to become huge so some thought is being put in as to how to keep it logical.

To Add to this

if/when NESARA/GESARA

get’s implemented,

just about all bank scams

will disappear and

become a thing of the past.

In the meantime, visit the other pages, linked above, for more information.

click image for PDF

The Banking Swindle

by Kerry Bolton

(PDF)

Dr John Kenneth Galbraith,

American Economist

and Presidential Adviser,

Money: Whence it came,

where it went (1975)

There are movements around the world that attempt to combine the thinking of many individuals and movements that have attempted to free peoples and nations from ‘the thrall of interest slavery’.

What has been missing, until the appearance of Dr. Bolton’s book, is a single work that brings together all of them.

Kerry Bolton has constructed an instrument to teach mankind to understand the system of debt slavery and that system’s false rationale.

This is the book you hold in your hand.

It is weapon to slay a tyranny who has almost limitless power to control- through the private monopoly of money and credit- almost every aspect of the life of the individual and society.

The study of money, above all other fields in economics, is one in which complexity is used to disguise truth or to evade truth, not to reveal it.

The process by which banks create money is so simple the mind is repelled.

With something so important,

a deeper mystery seems only decent.

click image or buton for PDF

Fruits

from a poisonous tree

(pdf e-book)

Several months prior to the writing of this book,

I began questioning my motivation for doing so.

I have a well educated, firmly established in the legal profession and most importantly of all, I have a loving, caring family.

What then motivated me to take on both the state and federal governments, the proverbial biggest bullies on the block?

The answer is that I had discovered that both the state and federal governments have been lying to and stealing from We the People.

Of all criminals,

the ones that are personally

repugnant to me are liars and thieves.

These species of criminal I cannot abide in any manner, from any source, especially the government.

Ergo, the years of research uncovering the story you are about to read.

The government and the international Global Elite have systematically stolen our wealth and our birthright as Americans.

The title of this book,

FRUITS FROM A POISONOUS TREE,

explains the theft of our wealth and identity,

and the book tells what we can do about it.

click image for video

WHO OWNS AUSTRALIAN BANKS?

(BLACKROCK, VANGUARD ETC)

See where YOUR money goes

and why Australian governments

kow-tow to the whims of these

oligarchs – Australia is owned

by USA – Wall Street – Rothschilds

click image for video

Strawman

The nature of the cage

Remastered

John K. Webster

To celebrate 1.4 million views and the 8-year anniversary of the release of the Strawman documentary, the producers have adjusted the content of the film.

This is not a different documentary; it has just been edited and cleaned up after listening to viewer feedback and making some adjustments.

Strawman - The nature of the cage

is a cutting-edge documentary like no other.

It highlights the truth around debt, Legal Fiction, Lawful and Legal, Debt Collectors, Bailiffs, and modern-day Policing.

The film gives a detailed overview as to how you can address these issues in your personal life, offering knowledge on how to Lawfully deal with any kind of authority, if you haven't broken any Laws.

Drawing on the expertise of Trailblazers who have risked everything to deliver this usually unavailable information, Strawman will outline information that you would otherwise be completely unaware of.

John K Webster, who has spent 18 months researching and making this film, has one goal... having noticed the increase in suicides in the UK that relate directly to monetary worries, he says "If this film saves one life, my work is done."

This film applies to everyone, regardless of their personal situation.

It is important to know how the system works and more importantly, how it is working for you.

It is said, that you must first know that you are in a cage before you can escape from that cage.

Australia’s Central Bank

says it is bust

September 2022

After the Australian fiscal year ended in June, the Reserve Bank of Australia marked its bond holdings to market – wiping out all its reserves.

The central bank of Australia on Wednesday made the astonishing admission that it is, basically, bust. Its entire equity has been wiped out by pandemic-related bond buying.

Of course, the Reserve Bank of Australia is a central bank, and can print money. So it can work its way out of a situation that would bankrupt a conventional bank or company.

Still, as the U.S. Federal Reserve meets today on interest rates, it’s an interesting insight into the challenges other central bankers face as they attempt to reconcile Covid stimulus with post-Covid inflation and economic emergence.

The RBA began its bond-purchase program in November 2020 as a second stimulus package in response to the pandemic.

The first round of measures saw it slash rates to record lows, and set up a term funding facility offering cheap three-year funding to banks.

For the bond buying, the central bank bought Australian government bonds and semi-government securities in the secondary market to lower interest rates on bonds maturing between five and 10 years out.

The program was extended, and extended, and extended yet again. Ultimately, the RBA bought A$281 billion (US$188 billion) in national, state and territory government bonds.

Now the bill has come due.

The RBA will announce its full-year results for the Australian fiscal year through June 30 in a month or so.

But they won’t be pretty.

The central bank has had to mark the value of its holdings to market, resulting in a A$44.9 billion (US$30.0 billion) valuation loss.

Offset by A$8.2 billion (US$5.5 billion) in underlying earnings from the central bank’s holdings, and it is posting a net loss of A$36.7 billion (US$24.5 billion).

That has exhausted the bank’s A$15.4 billion reserve fund and A$8.4 billion in other reserves, and then some. So the RBA is in negative equity to the tune of A$12.4 billion (US$8.3 billion).

“If any commercial entity had negative equity, assets would be insufficient to meet liabilities, and therefore the company would not be a going concern,” RBA Deputy Governor Michele Bullock explains in outlining the central bank’s situation. “But central banks are not like commercial entities.”

The RBA has a government guarantee against its liabilities, meaning “there are no going concern issues with a central bank in a country like Australia,” she says by way of reassurance.

And of course the central bank can simply print more money, so “the Bank can continue to meet its obligations as they become due and so is not insolvent.

The negative equity position will, therefore, not affect the ability of the Reserve Bank to do its job.”

A license to print money to get out of that kind of problem is never, however, going to be good news for your currency.

And indeed, the Aussie dollar has lost 13.6% of its value against the U.S. dollar since early April. Look back 18 months, and the decline in what some Aussies joking call the “Pacific peso” is 19.5%.

It’s a far cry, with US$1 now buying you A$1.50, from 2013, when the Aussie dollar briefly rose above parity to become stronger than its U.S. counterpart.

However, the Australian government was forced to inject cash into the central bank in 2013 because it had suffered losses on its foreign-currency reserves.

The RBA notes it’s not requesting any cash injection now.

With interest rates rising in Australia, the RBA is in the unenviable position of having to pay out higher interest on its liabilities than it is able to earn on the bonds and other assets it has been buying.

“In other words, underlying earnings are negative,” Bullock says. “It is difficult to be precise about how long this situation will last or how big these negative earnings will be.”

On the plus side, having marked to market at June 30, the central bank finds that its bond holdings are now valued below their face value at maturity.

As a result, it should be making capital gains as the bonds come due.

The RBA is now going to run its bond portfolio back down.

The RBA slashed rates to a record low of 0.1% in November 2020.

The Aussie central bank has now hiked three times, bringing the current interest rate to 2.35% as of its September 6 meeting.

It is next due to meet on rates on October 4.

As of the end of the June quarter, the RBA held A$356 billion (US$238 billion) in Australian government bonds, and also has another A$188 billion (US$125 billion) in assets connected to the term funding facility.

Across the entire government, the entity that issues the Aussie government’s debt – the Australian Office of Financial Management – will be reporting a significant gain on the liabilities it has issued, equivalent to the losses that the RBA has had to write down.

The RBA notes that other central banks would be in a similar position but use different accounting methods.

The Bank of England and the Reserve Bank of New Zealand both have an indemnity from the government on any losses.

So their governments would essentially bail them out, something the RBA stresses it is not asking the Australian government to do.

However, the RBA typically contributes its profits to the government coffers as a dividend.

The government likely should expect a hole in its budget where that dividend contribution used to be, for “the next few years,” Bullock says.

The last bonds mature in 2033.

Similarly, the Swiss National Bank reported a first-half loss of 95.2 billion Swiss francs (US$98.7 billion), its largest since the central bank was set up in 1907.

Falling bond prices and the appreciation in the Swiss franc ate into its huge foreign-currency holdings, but like the RBA the loss is on paper until the bonds mature.

The bottom line, Bullock says, is that central banks had to spend their way out of the pandemic crisis if their economies were going to stay afloat.

In that sense, the RBA’s bond buying “broadly achieved its aims,” she concludes.

click image for video

Bank of England

says it is bust

October 2022

If you can understand the Gobbledegook the The Bank of England has come out with, it’s actually declaring itself broke.

This means that people’s money and pension funds will likely be down the toilet.

In another move, on the weekend of 15th October 2022 the bank told it’s fund managers to ‘Balance’ their accounts – which, essentially means ‘sell everything’.

Click arrow icon below on right to see/un-see article

THE CAUSE OF THE 2008

FINANCIAL CRISIS

A look back at the

2008 financial crisis

compared to the

current financial crisis

we are facing

The 2008 financial crisis was one of the most significant economic downturns in modern history.

It was a catastrophic event that affected the entire world, causing widespread unemployment, foreclosures, and financial instability.

The crisis was triggered by a combination of factors, including the housing bubble, financial deregulation, the housing market collapse, high levels of subprime mortgage lending, and the widespread use of complex financial instruments and the greed of the banking industry.

As a result, many financial institutions faced insolvency, leading to a wave of bank failures and bailouts.

One of the main causes of the 2008 financial crisis was the housing bubble.

-0-0-0-0-

The financial industry too ran for cover and did it’s best to blame the crisis on ordinary people – bankrupting them and destroying them financially.

At the same time it rewarded itself buy ‘buying (taking over) properties and assets at pennies in the dollar and printing massive amount of worthless money to bail itself out.

This worthless money was ultimately released into normal society where it devalued what was already there.

To overcome this – ‘lending’ institutions raised interest rates.

In all, it was almost a rinse-repeat of the causes of the great depression – but on steroids.

The end result was that the rich got richer while ordinary people was financially wiped out.

There is no doubt the crisis

was manufactured over a

number of years by bankers

to enrich themselves at the expense

of ordinary people.

Click arrow on right for full article and to close

THE CAUSE OF THE 2008

FINANCIAL CRISIS

A look back at the

2008 financial crisis

compared to the

current financial crisis

we are facing

The 2008 financial crisis was one of the most significant economic downturns in modern history.

It was a catastrophic event that affected the entire world, causing widespread unemployment, foreclosures, and financial instability.

-0-0-0-0-

The financial industry too ran for cover and did it’s best to blame the crisis on ordinary people – bankrupting them and destroying them financially.

At the same time it rewarded itself buy ‘buying (taking over) properties and assets at pennies in the dollar and printing massive amount of worthless money to bail itself out.

This worthless money was ultimately released into normal society where it devalued what was already there.

To overcome this – ‘lending’ institutions raised interest rates.

In all, it was almost a rinse-repeat of the causes of the great depression – but on steroids.

The end result was that the rich got richer while ordinary people was financially wiped out.

There is no doubt the crisis

was manufactured over a

number of years by bankers

to enrich themselves at the expense

of ordinary people.

The crisis was triggered by a combination of factors, including the housing bubble, financial deregulation, the housing market collapse, high levels of subprime mortgage lending, and the widespread use of complex financial instruments and the greed of the banking industry.

As a result, many financial institutions faced insolvency, leading to a wave of bank failures and bailouts.

One of the main causes of the 2008 financial crisis was the housing bubble.

In the years leading up to the crisis, housing prices had risen dramatically, deliberately fuelled by low interest rates and lax lending standards.

This created a housing bubble that eventually burst, causing housing prices to plummet and leaving many homeowners with mortgages they could not afford.

As a result, many homeowners defaulted on their mortgages, leading to a wave of foreclosures that put additional pressure on the housing market.

Another main factor that contributed to the crisis was financial deregulation.

In the 1980s and 1990s, the U.S. government began to deregulate the financial industry, which allowed banks and other financial institutions to take on more risk.

This led to the creation of complex financial instruments such as mortgage-backed securities and collateralized debt obligations (CDOs), which were sold to investors around the world.

These financial instruments were often based on subprime mortgages, which were loans made to borrowers with poor credit histories.

The banking industry played a significant role in the crisis as well.

Many banks engaged in risky lending practices, such as giving loans to people with poor credit histories, and then packaged those loans into complex financial instruments that were sold to investors.

When the housing bubble burst and homeowners began defaulting on their mortgages, the value of these financial instruments plummeted, leading to massive losses for banks and investors.

Greed also played a role in the crisis.

Many people in the banking industry were motivated by short-term profits and bonuses, rather than long-term stability.

This led to a culture of risk-taking and excessive borrowing that ultimately contributed to the financial crisis.

In addition to these factors, there were also broader economic trends that contributed to the crisis.

For example, the U.S. trade deficit, which had been growing for decades, put pressure on the economy by increasing the amount of money flowing out of the country.

The high levels of consumer debt and low savings rates also made the U.S. economy more vulnerable to a financial crisis.

THE SOLUTION FOR THE 2008 FINANCIAL CRISIS

The first solution was the Troubled Asset Relief Program (TARP), which was enacted in October 2008.

TARP was a government program designed to purchase toxic assets from financial institutions in order to stabilize the financial system.

The program was initially funded with $700 billion, which was later reduced to $475 billion.

The program was controversial, as many people believed it was a bailout for Wall Street at the expense of Main Street.

However, supporters argued that it was necessary to prevent a total collapse of the financial system, which would have had disastrous consequences for the entire economy.

The second solution was the American Recovery and Reinvestment Act (ARRA), which was enacted in February 2009.

ARRA was a stimulus package designed to jumpstart the economy and create jobs.

The package included tax cuts, infrastructure spending, and aid to states and local governments.

The total cost of ARRA was $831 billion.

Critics argued that the package was too expensive and would lead to inflation, but supporters argued that it was necessary to prevent a deeper recession.

The third solution was the Dodd-Frank Wall Street Reform and Consumer Protection Act, which was enacted in July 2010.

Dodd-Frank was a comprehensive financial reform law designed to prevent another financial crisis.

The law included provisions to increase oversight of the financial industry, strengthen consumer protections, and regulate complex financial instruments.

Critics argued that the law was too burdensome for small businesses and would stifle economic growth, but supporters argued that it was necessary to prevent another financial crisis.

The fourth solution was the Federal Reserve’s monetary policy.

The Federal Reserve is responsible for setting monetary policy, which includes controlling interest rates and managing the money supply.

During the financial crisis, the Federal Reserve implemented a number of unconventional monetary policies, such as quantitative easing and forward guidance.

These policies were designed to stimulate the economy by lowering interest rates and increasing the money supply.

While these solutions were controversial and had their critics, they were ultimately successful in temporarily stabilizing the financial system and preventing a deeper recession. The 2008 financial crisis was a sobering reminder of the importance of effective regulation and oversight of the financial industry, and of the need for policymakers to act quickly and decisively in times of crisis.

WHAT DID WE LEARN

FROM THE 2008 FINANCIAL CRISIS

(THAT WE DID NOT APPLY

TO PREVENT THE CURRENT CRISIS)?

… apart from failing to realise that

banks NEVER lose their own money

as they don’t have any money

of their own to lose.

They only EVER lose OUR money!

These financial calamities are engineered

by banks on a regular basis so

they can cash-in on the sale of the assets

we can’t afford to repay –

our assets that they don’t own.

And we allow them to do it to us

over and over again.

And until we do, this will never end.

This crisis had a profound impact on the world economy, leading to significant job losses, bankruptcies, and a decline in consumer confidence.

The crisis taught us several valuable lessons that should have been applied and follow to prevent a similar or more drastic financial crisis like the one we are facing right now.

One of the most important lessons that we learned from the 2008 financial crisis is the importance of regulation. The crisis was caused by the lack of regulation in the financial sector.

The banks were allowed to engage in risky practices such as lending to people with poor credit scores and packaging these loans into securities that were sold to investors.

This lack of regulation allowed the banks to take on excessive risk and contributed to the collapse of the housing market.

Another lesson that we learned from the 2008 financial crisis is the importance of transparency.

One of the reasons why the crisis spread so quickly was because investors were unaware of the risks associated with the securities that they had invested in.

Many of these securities were complex and difficult to understand, and the banks did not provide sufficient information about the risks involved.

This lack of transparency made it difficult for investors to make informed decisions, which ultimately contributed to the collapse of the financial system.

The 2008 financial crisis also taught us about the importance of diversification.

One of the reasons why the crisis had such a widespread impact was because many investors had all their money invested in the housing market.

When the housing market collapsed, these investors lost a significant amount of money.

Another lesson that we learned from the 2008 financial crisis is the importance of preparedness.

The crisis caught many people off guard, and there was a lack of preparation for such an event.

The 2008 financial crisis also taught us about the importance of global cooperation.

The crisis was a global event, and it required a coordinated response from governments and financial institutions around the world.

Today, there is a greater emphasis on global cooperation, and countries are working together to prevent similar events from occurring in the future.

HOW DID WE GET HERE AGAIN…?

The current financial crisis we are facing in America has been caused by a number of factors that have built up over time.

The roots of the crisis go back to the early 2000s when the housing market was booming, and banks and financial institutions were lending money to people who could not afford to repay it.

This led to a bubble in the housing market that eventually burst, causing a chain reaction throughout the financial system and as a result the 2008 financial crisis.

Compared to the 2008 financial crisis, in today’s banking crisis we have a whole bunch of additional contributing factors that we did not have back in 2008.

First and foremost we have the whole “covid” “pandemic”.

And we have all of the uncertainties that were a result of this so-called pandemic.

Think about how many companies and businesses went under as a result of the fallout of this pandemic”.

And then you think about the people who lost their job because of many companies and businesses going under.

And then there are the people who lost their job because they refuse to get the Covid jab.

And many of those people who did lose their job or quit their job because of the Covid jab they ended up getting a job that paid half or even a quarter of what they were making if they’re even able to find a job.

And since mortgages are typically the biggest expense that people have it’s usually the first one that they are unable to pay.

Which results in them defaulting on their loan and then if you times that by a million people boom you have a financial crisis.

And it is a fact that in less than 3 months and only a handful of banks we are already past the amount of the 2008 crisis that happened over the period of 14 months and a whole bunch of banks.

So it can use that as a gauge to determine just how much worse the current financial crisis is compared to 2008.

And once again, one of the key factors that has contributed to the current financial crisis was the practice of subprime lending.

Banks and other financial institutions were once again offering mortgages to people who had poor credit histories or low incomes, and who would not normally have been able to afford a home.

These mortgages were packaged together and sold as securities to investors, who believed that they were low-risk investments.

As the result of Covid and all that it affected, it cause millions of people to default on their mortgage that caused the housing market to collapse again, and once again these securities became worthless, causing huge losses for investors and financial institutions.

And once again, another factor that contributed to the current financial crisis was the use of derivatives and other complex financial instruments.

These instruments allowed financial institutions to make huge bets on the housing market and other assets, often using borrowed money. When the market turned against them, these bets turned into huge losses, which many institutions were unable to absorb.

The current financial crisis was also exacerbated by the lack of regulation and oversight in the financial industry.

Many of the practices that led to the crisis, such as subprime lending and the use of derivatives, were legal at the time and were not subject to effective regulation or oversight.

This allowed financial institutions to take huge risks without fear of consequences, which ultimately led to the collapse of the financial system.

The crisis was further compounded by the interconnectedness of the financial system.

When one institution began to fail, it had a ripple effect throughout the entire system, as other institutions that had lent money to that institution also began to suffer losses.

This led to a domino effect, with institutions collapsing one after the other, ultimately leading to the failure of the entire financial system.

The solution is not what we did in 2008 because 15 years later not only are we back in the same situation but is 10 times worse this time around. Printing more money and bailing banks out is not the solution, that is only a temporary bandaid.

If we are going to make America great again we need to skip using a bandaid for a temporary fix and come up with some permanent solution so we don’t end up in this place again 10 or 15 years from and have it be 10 times worse or more than the current financial crisis we are facing.

As you know, I have said many times before that the central banks and the Federal Reserve are NOT the solution to this problem.

If it was the solution, we would not be here again 15 years later.

The solution is to get rid of all the corrupt and greedy “central” banks, the solution is to get rid of the corrupt and greedy Federal Reserve that prints endless amounts of paper monopoly money that is literally worthless and then loans it to the federal government with interests that we the people pay for.

Not to mention all the worthless money they print in order to fund their corrupt agenda, like send endless amounts of money to Ukraine instead of focusing on our own financial problems here in America.

The first part of the solution is decentralized banks, many of them all over the country that are locally owned and managed, not 5 or 10 BIG banks that own everything….

The second part of the solution is a financial system that is secure, reliable and accountable that can not be taken over or corrupted by the Deep State Cabal.

The third part of the solution is American needs to be put back on the Gold Standard, this would allow us to regulate the amount of current we have in accordance to the gold we have in our reserves which would allow is to properly regulate our economy.

This would also allow for low or no inflation and low interest rates across the board. The fourth part of the solution is the United States Treasury needs to print our currency that is backed by gold.

The amount of currency we have on hand must match what we have in our Gold reserves.

The fifth and final part of the solution is we need strict oversight, regulation and accountability on the entire financial system and all of its processes.

We also need people who we can trust to manage and operate the financial institutions in our nation with honesty and integrity.

Until we implement the above solutions or similar solutions to our financial problems, we will continue to have the same issues over and over.

I think it’s safe to say that none of us want to give our children, grandchildren and even great-grandchildren the financial problems we are facing today.

We the people need to press our elected officials to take actin to get these changes implemented.

One thing is very clear, we can not continue on the current financial path we are on as it will only lead to more destruction as time goes on.

Trevor Winchell

Click arrow icon below on right to see/un-see article

A VERY good solution

for our current banking crisis…

Regarding our current banking crisis, let’s ask ourselves the most basic and most simple question regarding this situation.

If people who have deposited money into a bank and trusted their bank with that money over the course of time and if those people went to their bank today to withdraw all their money technically that money should be available for them to withdraw.

But the problem we’re having is the money is not there so the question we need to ask, where is that money?

Those of us who are awake we know where that money is, these banks are using people’s money unknowingly to invest in other ventures to increase their wealth and the banks are getting wealthy and the people whose money they’re using to invest don’t benefit from this one bit.

This is on of the many reasons why we are in the situation we are in with this banking crisis because people are withdrawing their money out of fear and panic which is causing a run on the banks and obviously they don’t have the money on hand to cover this withdrawals so then they need to be bailed out by the federal government which is basically firing up the money printing presses and printing more money to bail these Banks out and we’re just getting further and further deeper into this mess.

I’ve been saying this for a very long time there’s a very simple solution to this problem.

Get rid of the central bank system all together

and get rid of the Federal Reserve

and put the United States back

on the gold standard with a

secure financial system to replace

these corrupt Central Bank systems.

Click arrow on right for full article and to close

A VERY good solution

for our current banking crisis…

Regarding our current banking crisis, let’s ask ourselves the most basic and most simple question regarding this situation.

If people who have deposited money into a bank and trusted their bank with that money over the course of time and if those people went to their bank today to withdraw all their money technically that money should be available for them to withdraw.